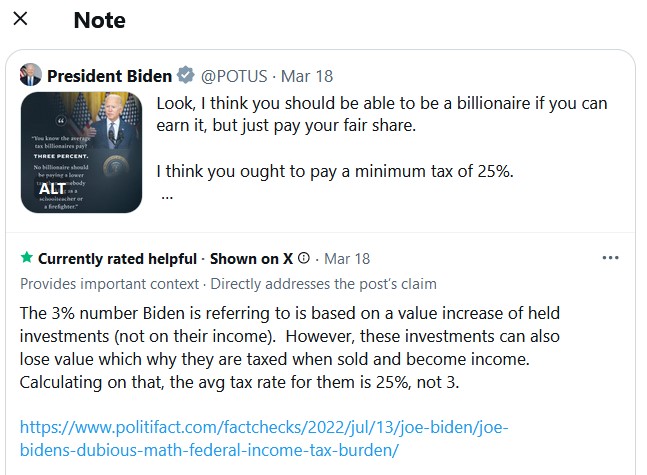

Joe Biden recently tweeted his thoughts on how billionaires should pay their “fair share.” Twitter users instantly humiliated Biden’s claims with a community fact-check on his ideas. Biden said in his post, “Look, I think you should be able to be a billionaire if you can earn it, but just pay your fair share. I think you ought to pay a minimum tax of 25%. It’s about basic fairness.” The post is followed by a photo with a quote from Biden, stating, “You know the average tax billionaires pay? Three percent. No billionaire should be paying a lower tax than somebody working as a schoolteacher or firefighter.”

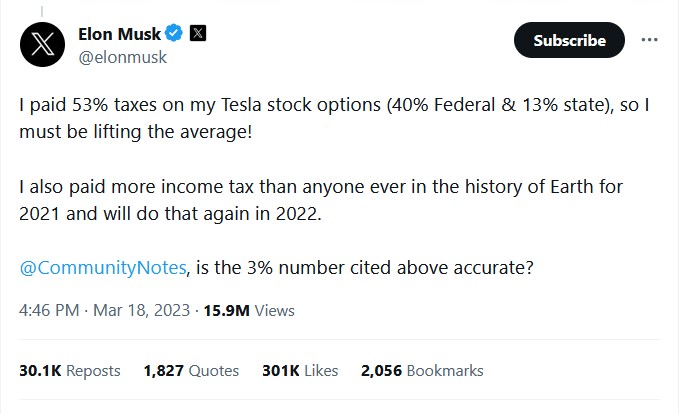

As you can imagine, the responses in the comment section ranged from conservatives pointing out that everyone is already being overtaxed and socialists arguing workers are being exploited by billionaires. However, one of the most popular responses to Biden was Elon Musk slamming the assertion that he only pays 3% in taxes. Musk said, “I paid 53% taxes on my Tesla stock options (40% Federal & 13% state), so I must be lifting the average! I also paid more income tax than anyone ever in the history of Earth for 2021 and will do that again in 2022. @CommunityNotes, is the 3% number cited above accurate?” He continued, “I certainly agree that everyone should pay taxes and not engage in elaborate tax-avoidance schemes. Would be curious to hear how these other “billionaires” are so good at avoiding taxes! We should get rid of GRATs, but maybe other things too.”

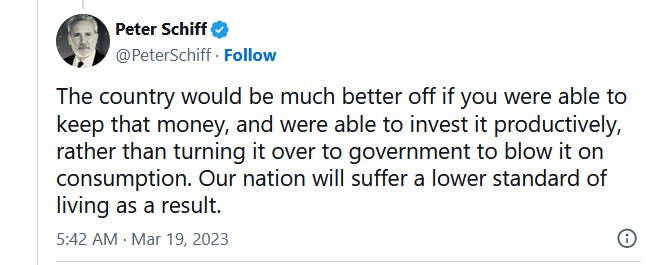

Chief Economist and Global Strategist Peter Schiff also criticized taxation and how the government is so inefficient at managing tax revenue. Schiff said, “The country would be much better off if you were able to keep that money, and were able to invest it productively, rather than turning it over to government to blow it on consumption. Our nation will suffer a lower standard of living as a result.”

Financial commentator Natalie Brunell also pointed out the macroeconomic effects of increasing taxation. Anyone who has taken an introductory economics course understands that as the government increases taxation, it decreases business investment. In other words, there will be fewer jobs. Brunell said, “How can we expect people who produce nothing (except debt) to understand business? I’m reminded of this Ayn Rand passage: ‘If an average housewife struggles with her incomprehensibly shrinking budget and sees a tycoon in a resplendent limousine, she might well think that just one of his diamond cuff links would solve all her problems. She has no way of knowing that if all the personal luxuries of all the tycoons were expropriated, it would not feed her family—and millions of other, similar families—for one week; and that the entire country would starve on the first morning of the week to follow . . . . How would she know it, if all the voices she hears are telling her that we must soak the rich?'”

"*" indicates required fields

The tweet continues, “No one tells her that higher taxes imposed on the rich (and the semi-rich) will not come out of their consumption expenditures, but out of their investment capital (i.e., their savings); that such taxes will mean less investment, i.e., less production, fewer jobs, higher prices for scarcer goods; and that by the time the rich have to lower their standard of living, hers will be gone, along with her savings and her husband’s job—and no power in the world (no economic power) will be able to revive the dead industries (there will be no such power left).”